In our community of East New York and Cypress Hills we have the greatest number of family homes on the tax lien sale. The homeowners and tenants who live in these homes must not be made more vulnerable after this pandemic has put too many at financial risk. As outlined in an op-ed published in the Daily News earlier this summer, the tax lien sale impacts New York’s Black communities and communities of color hardest–the same populations that have been disproportionately hurt by the COVID-19 pandemic. Seniors, too, are particularly vulnerable.

In previous years, the Department of Finance has conducted extensive outreach, including in-person tax lien clinics, to ensure that property owners understand the lien sale and can take steps to enter into payment plans, apply for property tax exemptions, and pay off their arrears.

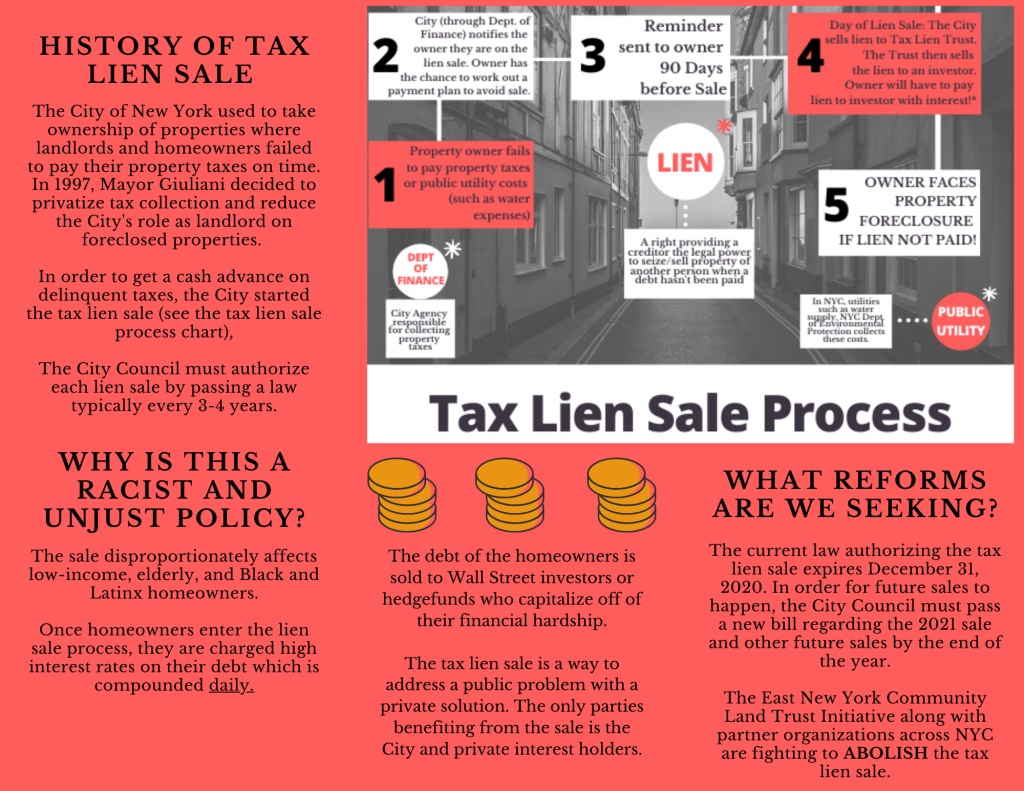

Due to COVID-19, the Department of Finance has been unable to have these outreach events, meaning that thousands of property owners will be unable to access the information and resources they need to get off of the lien sale. Without appropriate outreach, the tax lien sale cannot go forward as planned. Please ACT NOW to abolish it completely to ensure that we do not compound the financial hardships of vulnerable New Yorkers.

Actions to Take If You Need Assistance!!

Visit the NYC Dept of Finance Tax Lien Information Page.

Call the NYC Dept. of Finance Tax Lien Ombudsperson: (212) 440-5408 to ask to be removed from the list while you resolve outstanding issues.

The NYC Dept. of Finance Office of the Taxpayer Advocate: (212) 312-1800 to help make a plan for exemption or payment plan. Email: DOFTaxpayerAdvocate@finance.nyc.gov

Contact CHLDC Housing Counseling: (718) 647-2800 or visit cypresshills.org

Small homeowners can get help by calling the Center for NYC Neighborhoods: (646) 786-0888 or by visiting cnycn.org/get-help/

You must be logged in to post a comment.