ABOLISH THE TAX LIEN SALE

Our first city-wide policy campaign has been to push back against the city’s tax lien sale, a vestige of the Giuliani era. By selling municipal property and utility debts to private collectors, the city dispossesses longtime homeowners and relinquishes public leverage over delinquent and neglectful landlords.

The East New York Community Land Trust began organizing against the lien sale in 2020 when member Niani Taylor came to our policy committee meeting and said did you all know that East New York and Brownsville had the highest number of properties on the lien sale compared to any other neighborhood in NYC. We began investigating. We learned that the City is six times more likely to sell a tax lien in Black neighborhood than a white neighborhood.

Diagram of the existing NYC Tax Lien Sale system by Sam Kattan and Rania Dalloul (March 2022).ABOLISH THE TAX LIEN SALE COALITION

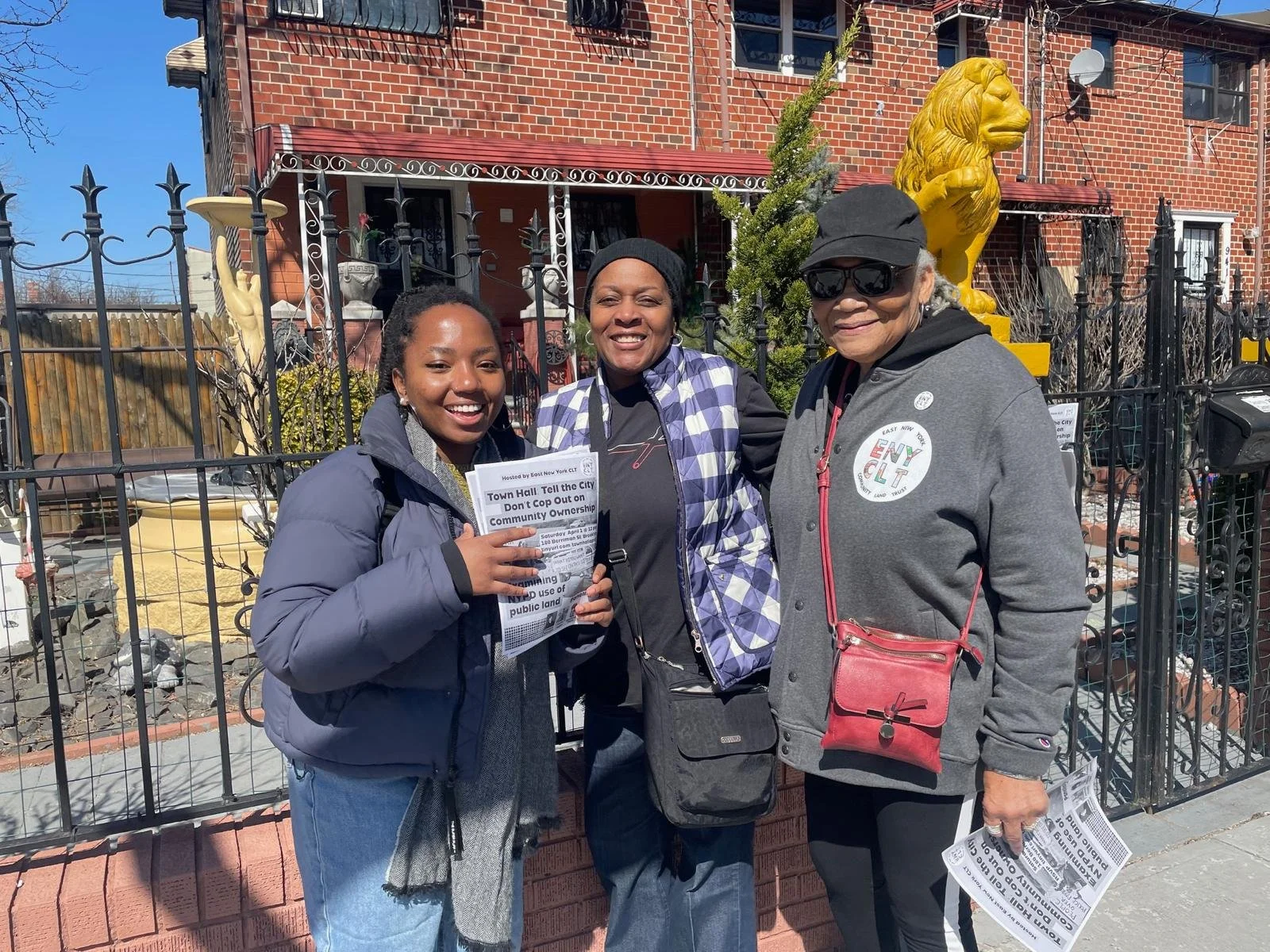

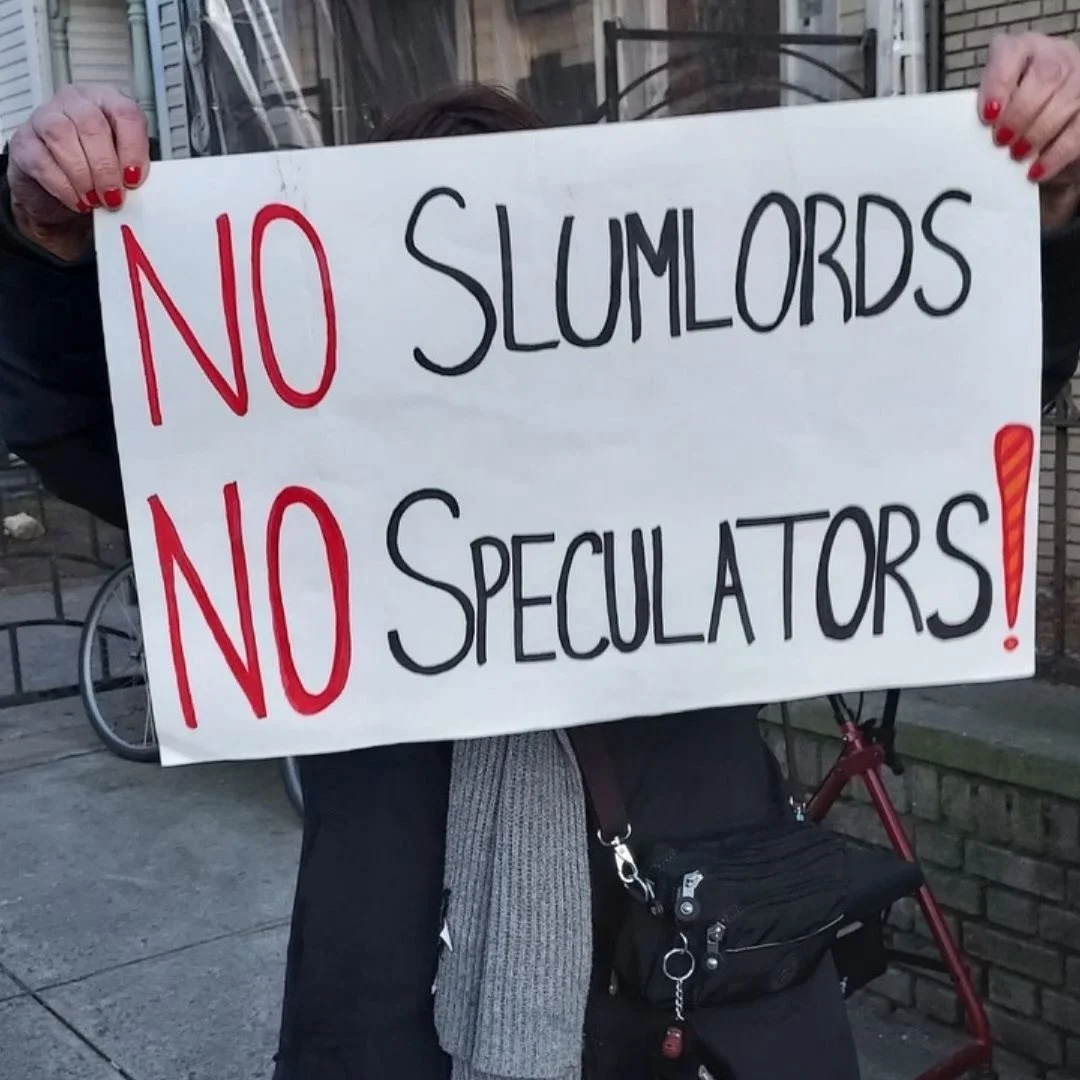

In response, we convened the city-wide Abolish the NYC Tax Lien Sale Coalition to stop the displacement of longtime BIPOC homeowners for small tax debts, enact protections for tenants in tax lien sale-affected buildings, and to create a new system of debt collection that keeps people in their homes and creates a property pipeline for CLT homes. We have conducted outreach to countless homeowners and tenants, produced reports, held rallies and press conferences, and beat the drum about the predatory nature of the lien sale.

COALITION MEMBERS

East New York CLT (Lead), New Economy Project, TakeRoot Justice, Western Queens CLT, Bronx CLT, Community Service Society of New York, Northwest Bronx Community and Clergy Coalition. Brooklyn Level Up, Coalition for Community Advancement, New York City Community Land Initiative, MHANY Management Inc.

ENDORSERS

New York Civil Liberties Union, New York Communities For Change, Center for NYC Neighborhoods

OUR VICTORIES

Although this fight is still ongoing, our efforts garnered several victories in the years since the campaign began, including a 3-year moratorium on the sale itself, public funding to support homeowners and reforms to the policy itself.

Most recently, we forced the introduction of two bills that will end the lien sale as we know it. This legislation will authorize a publicly accountable land bank to handle city debt and will prioritize CLTs to keep residents in their homes and preserve these homes as affordable housing for generations.

LEGISLATION

Pass these bills:

Intro 570-A (CM Brewer): would establish a land bank in New York City. Community land trusts, community housing development organizations, and nonprofit organizations would be prioritized for disposition for the creation or preservation of affordable housing.

Intro 1407 (Speaker Adams): The proposed amendment modifies tax lien sales by: 1) requiring City Council approval for sales (except to land banks); 2) setting foreclosure conditions for owner-occupied 1-3 unit properties; and 3) eliminating the December 31, 2028 sunset date.

Intro 1420 (CM Nurse): The proposed bill would require the DOF commissioner to transfer/sell any liens that the city has an interest in are held in a lien sale trust to a land bank within six months of its creation.

2. Expand outreach, organizing and support to low-income homeowners who are struggling with tax and mortgage debt.

SELECTED MEDIA

Brick Underground: “Mayor Adams is bringing the tax lien sale back. Here’s how to get your property off the list” | May 16, 2025

Brownstoner: “Upcoming City Tax Lien Sale Puts Brooklyn Homeowners at Risk, Advocates Say” | Apr. 21, 2025

2025

The City: “How NYC’s Unpaid Property Tax System Has Left Some Harlem Tenants in the Lurch” | Jun. 28, 2024

The City: “Council and Mayor Move to Revive Stalled Property Tax Debt Collections” | Jun. 18, 2024

The City: “Pushback Grows as Council and Mayor Hash Out Deal to Revive Property Debt Sell-Off” | Apr. 11, 2024

Gothamist: “NYC’s debt collection program is being replaced. Advocates hope its flaws can be fixed” | Apr. 11, 2024

2024

2023

The Real Deal: “One year later, city hasn’t renewed or fixed lien sale” | Feb. 22, 2023

Gotham Gazette: “Majority of City Council Declares Opposition to Reauthorizing NYC Tax Lien Sale” | May 31, 2022

Brooklyn Paper: “Controversial Tax Lien Sale Comes to a Bitter End, For Now” | Mar. 1, 2022

City Limits: “As NYC Considers Scrapping Tax Lien Sale, Land Trust Plan Gains Steam” | Feb. 28, 2022

Harlem World: “Activists And Electeds Cheer End Of The Rudy Giuliani Created NYC Tax Lien Sale” | Feb. 28, 2022

BK Reader: “Housing Rights Activists Put Tax Lien Sale on Trial for Displacing Families of Color in Brooklyn” | Feb. 16, 2022

The Baffler: “Lien on Me” | Feb. 10, 2022

The City: “Tax Lien Sales Tick Towards Expiration Date Without Alternative in Sight” | Jan. 27, 2022

2022

NYS Focus: “Tenants Suffer As City Sells Landlords’ Tax Debt to Speculators” | Oct. 15, 2021

BK Reader: “ Tax Lien Sale Is Happening in Dec and BK Organizers Are Rushing to Support Homeowners” | Sept. 13, 2021

Kings County Politics: “Tax Lien Sale Bill Asks for Reform Taskforce” | Feb. 3, 2021

2021

Politico: “Council rankles de Blasio administration after pulling tax lien bill” | Dec. 21, 2020

The City: “Council Considers Killing the Tax-Collection Machine Rudy Giuliani Built” | Oct. 22, 2020

Bklyner: “Activists And Lawmakers Call To Abolish City’s Tax Lien Sale” | Oct. 14, 2020