Abolish The Tax Lien Sale

The City Takes First Step Toward Abolishing the Lien Sale, Fight Isn’t Over.

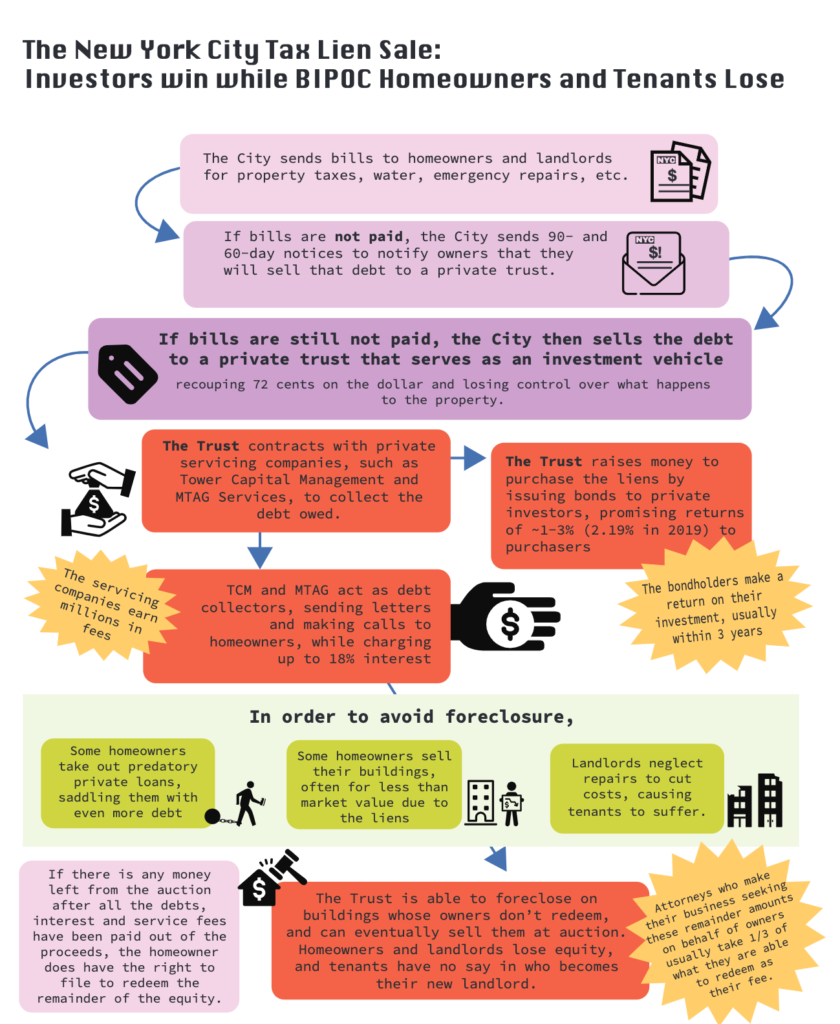

The Tax Lien Sale privatizes a core government function by transferring the management and collection of property tax arrears to private investors. As a result, investors and private debt servicers extract massive amounts of wealth from low-income Black and brown communities, push elderly and low-income homeowners and tenants into further distress, and leave neighborhoods littered with tax distressed vacant lots. Through the lien sale, the City also squanders powerful leverage it would otherwise have to develop and preserve tax- distressed properties as permanently affordable housing that New Yorkers urgently need, and for other community needs.

In 2020, we formed The Abolish the Tax Lien Sale Coalition to bring attention to the speculation and displacement fueled by New York City’s tax lien sale. Over the past four years, our coalition has led the call for an abolition of the tax lien sale and the creation of a new, equitable debt collection system that works for all New Yorkers. We conducted outreach to countless homeowners and tenants, produced reports, held rallies and press conferences, and beat the drum about the predatory nature of the lien sale.

After years of our advocacy and organizing, the City Council and Administration has finally recognized that the lien sale exacerbates inequity. At last the City will implement long overdue, commonsense protections for some of those harmed by the lien sale, including implementing pieces of our Coalition’s proposed framework:

- Funding for community based organizations (CBOs) to assist property owners. This assistance will help ensure that owners avail themselves of all that they have a right to, including exemptions, payment plans and the other options that will stem displacement of homeowners.

- Comprehensive notice that will let owners know the exemptions they may be entitled to, payment plans available to them, and other options they can use to avoid being included in the lien sale.

- Providing homeowners a “last resort” option to remain in their homes by voluntarily transferring their home to a community land trust (CLTs) or other organizations in exchange for clearing their tax debt while retaining some equity in their homes. For homeowners who want to remain in their home and community, this provides a pathway to do so while increasing the stock of permanently affordable housing in the City.

- Outreaching to tenants living in tax distressed properties and affirmatively addressing conditions in these properties.

- Dealing with distressed rental buildings. Landlords repeatedly eligible for the lien sale will have their buildings inspected for HPD violations. This can help address quality of life issues for tenants and could provide a pathway for resident ownership.

We are also relieved that the City Council has launched a new $1 million per year initiative that will include estate planning workshops; assistance drafting wills and other related legal documents; legal assistance and counseling on clearing titles on homes where the legal ownership is not clear due lack of estate planning or other issues (tangled titles); referrals to other services to address liens and other encumbrances on tangled titles; and other related services.

However, this legislation is only a first step towards a more just and equitable municipal debt collection system. We call on the City to:

- Fully Abolish the Predatory Tax Lien Sale and implement our proposed replacement system. The newly formed Task Force, which thanks to the advocacy of the Coalition includes community representation, must devise a debt collection system that is accountable to the people of New York.

- Pass legislation that meaningfully supports tenants living in tax-distressed properties. NYC City Council should pass a reformed city foreclosure program for distressed properties, a Land Bank, and the NYC Community Land Act package to bolster permanently affordable, community and tenant owned housing across the city.

- Work with Albany to implement a fair and equitable property taxation system. As it stands, New York’s property tax system imposes disproportionate burdens on Black and Brown communities. By asking property owners and tenants (who by extension contribute to the tax base through their rental payments) to pay more than their fair share in taxes they experience a disproportionate risk of being impacted by the lien sale.

What is the tax lien sale?

The tax lien sale, the policy of selling municipal debt to a private, investor-backed trust, fuels speculation and displacement in Black and brown neighborhoods, and siphons wealth from communities already disproportionately harmed by historic inequities like redlining and disinvestment.

In Summer 2020, ENYCLT convened a citywide coalition to demand that the City Council and the Mayor abolish the tax lien sale, and develop an alternative system of tax collection and property disposition that promotes neighborhood stability and equity through supporting community land trusts (CLTs).

Reports/Proposals:

Coalition members: East New York CLT, Community Service Society of New York, New Economy Project, TakeRoot Justice, Western Queens CLT, Brooklyn Level Up, Bronx CLT, Northwest Bronx Community and Clergy Coalition, the Coalition for Community Advancement and the New York City Community Land Initiative, MHANY Management Inc.

Endorsers: New York Civil Liberties Union, New York Communities For Change, The Center for NYC Neighborhoods

Campaign Milestones

-

- February 2022 – As a result of the work of the Coalition, authorization for the sale of liens to an investment-backed trust has expired. The Coalition is now working with elected officials and the administration on the design and implementation of a new debt collection system for New York City.

-

- The Coalition held two rallies in anticipation of the tax lien sale authorization law expiring on Feb. 28, 2022. We put the tax lien sale on trial for charges that included displacing families at our Feb. 12 rally (read the press release) and we bid it farewell at City Hall on Feb. 28. (read the press release).

-

- December 17, 2021 – The City held a tax lien sale despite the ongoing pandemic and major community opposition. Prior to the sale, ENYCLT members knocked on the door of every tax lien sale at-risk home in Council Districts 37 and 42 and were able to help many homeowners apply for the COVID-hardship exemption. The city sold the liens from 2,841 properties. According to DOF, 941 property owners who applied for the COVID hardship exemption were pulled from the lien sale.

-

- April 2021 – As required by Local Law 24, the Mayor and Speaker of the City Council to appoint a Task Force to study and publicly present alternative ways to handle debt collection outside of the tax lien sale. The law explicitly stated that the task force “must study the potential “transfer of properties with delinquent property taxes, sewer and water rents subject to a lien to community land trusts, land banks, mutual housing associations or other similar entities.” ENYCLT Board Secretary Debra Ack was one of only two community advocates appointed to the 11-member taskforce. She was supported by Paula Segal, attorney at TakeRoot Justice.

-

- January 2021 – In response to advocacy, the NYC City Council passed legislation reforming the New York City’s tax lien sale (Local Law 24 of 2021) significantly and paving the way towards ending the tax lien sale permanently. The bill permits the fewest liens to be sold on small homes in the history of the lien sale. Read details.

Read our collaboratively-developed framework for the collection of overdue municipal charges entitled “Leaving the Speculators in the Rear-View Mirror: Preserving Affordable Housing In NYC, a Municipal Debt Collection Framework.”

Selected Press:

The City: How NYC’s Unpaid Property Tax System Has Left Some Harlem Tenants in the Lurch | June 28, 2024

The City: Council and Mayor Move to Revive Stalled Property Tax Debt Collections | June 18, 2024

The City: Pushback Grows as Council and Mayor Hash Out Deal to Revive Property Debt Sell-Off | April 11, 2024

Gothamist: NYC’s debt collection program is being replaced. Advocates hope its flaws can be fixed. | April 11, 2024

The Real Deal: One year later, city hasn’t renewed or fixed lien sale | Feb. 22, 2023

Gotham Gazette: Majority of City Council Declares Opposition to Reauthorizing NYC Tax Lien Sale | May 31, 2022

Brooklyn Paper: Controversial Tax Lien Sale Comes to a Bitter End, For Now | March 1, 2022

City Limits: As NYC Considers Scrapping Tax Lien Sale, Land Trust Plan Gains Steam | Feb. 28, 2022

Harlem World: Activists And Electeds Cheer End Of The Rudy Giuliani Created NYC Tax Lien Sale | Feb. 28, 2022

BK Reader: Housing Rights Activists Put Tax Lien Sale on Trial for Displacing Families of Color in Brooklyn | Feb. 16, 2022

The Baffler: Lien on Me | Feb. 10, 2022

The City: Tax Lien Sales Tick Toward Expiration Date Without Alternative in Sight | Jan. 27, 2022

NYS Focus: Tenants Suffer As City Sells Landlords’ Tax Debt to Speculators | Oct. 15, 2021

BK Reader: A Tax Lien Sale Is Happening in Dec and BK Organizers Are Rushing to Support Homeowners | Sept. 13, 2021

Kings County Politics: Tax Lien Sale Bill Asks for Reform Taskforce | Feb. 3, 2021

Politico: Council rankles de Blasio administration after pulling tax lien bill | Dec. 21, 2020

The City: Council Considers Killing the Tax-Collection Machine Rudy Giuliani Built | Oct. 22, 2020

Bklyner: Activists And Lawmakers Call To Abolish City’s Tax Lien Sale | Oct. 14, 2020

You must be logged in to post a comment.